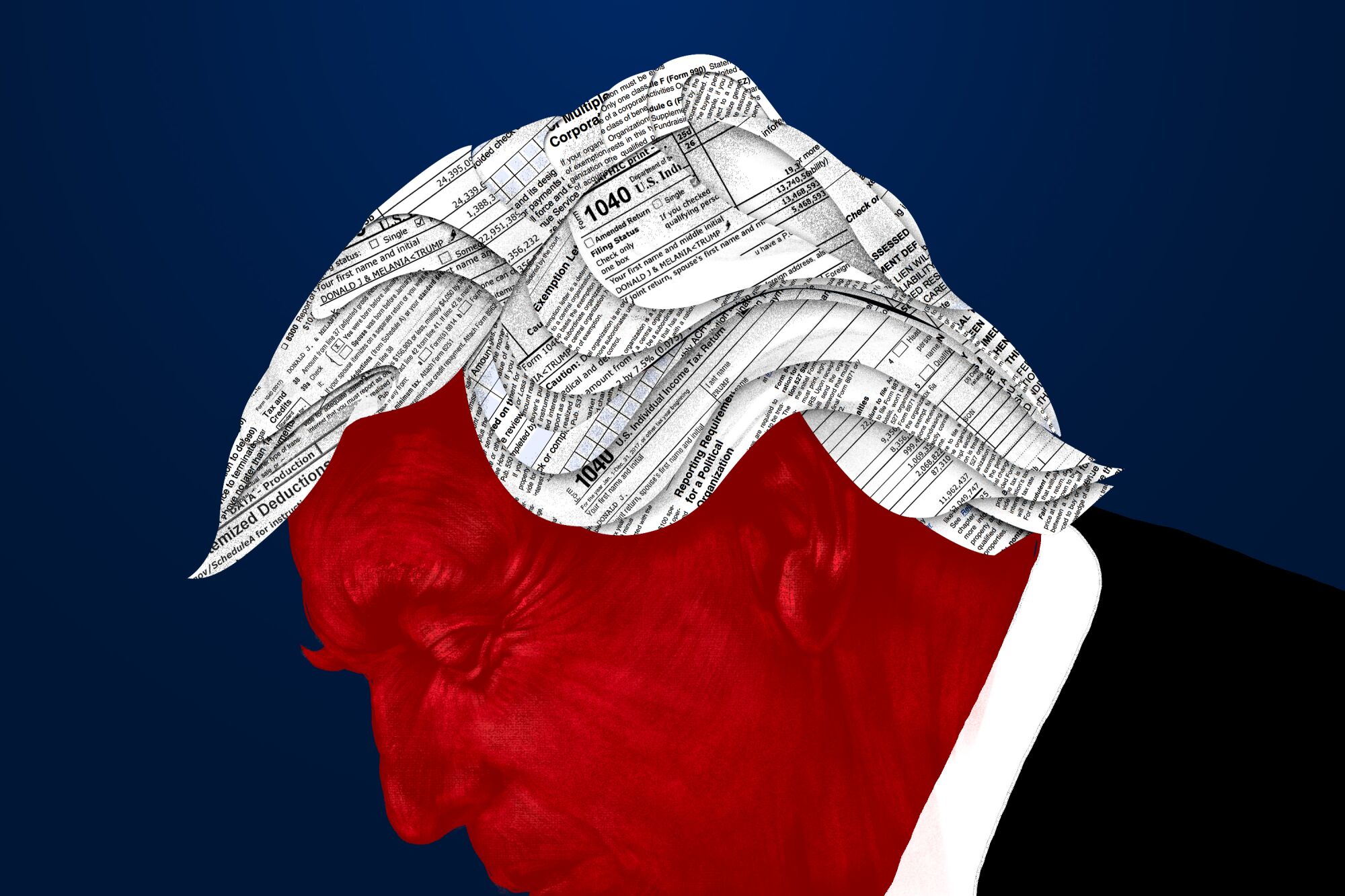

Image courtesy of Jim Cooke / Los Angeles Times.

Dear Commons Community,

Yesterday, the House Ways and Means Committee released Donald Trump’s tax returns which contained thousands of pages of documents. The New York Times has done an initial review and below is their analysis of key takeaways.

One item that The New York Times does not mention is the finding that Trump had significant investments in foreign countries including China, Azerbaijan, India, Indonesia, Panama, the Philippines, Turkey and the United Arab Emirates.

These raise the issue of potential conflicts of interest for the commander-in-chief of the United States and are one reason presidents normally release their tax returns.

I am sure that Trump’s tax returns will be the subject of a good deal of news analysis over the next several weeks.

Tony

———————————————————————–

The New York Times

Key Takeaways From Trump’s Tax Returns

By Jim Tankersley, Susanne Craig and Russ Buettner

Dec. 30, 2022

Democrats on the House Ways and Means Committee have followed through with their vow to make public six years of former President Donald J. Trump’s tax returns, giving the American public new insight into his business dealings and drawing threats of retaliation from congressional Republicans.

The release on Friday morning contained thousands of pages of tax documents, including individual returns for Mr. Trump and his wife, Melania, as well as business returns for several of the hundreds of companies that make up the real estate mogul’s sprawling business organization.

The committee had this month released top-line details from the returns, which showed that Mr. Trump paid $1.1 million in federal income taxes during the first three years of his presidency, including just $750 in federal income tax in 2017, his first year in office. He paid no tax in 2020 as his income dwindled and his business losses mounted.

The documents contain new details not revealed in those earlier releases. New York Times reporters are combing the pages for key takeaways. Here is a running list.

Trump made no charitable contributions in 2020.

As a presidential candidate in 2015, Mr. Trump said he would not take “even one dollar” of the $400,000 salary that comes with the job. “I am totally giving up my salary if I become president,” he said.

In his first three years in office, Mr. Trump said he donated his salary quarterly. But in 2020, his last full year in office, the documents show that Mr. Trump reported $0 in charitable giving.

Also in 2020, as the pandemic recession swiftly descended, Mr. Trump reported heavy business losses and no federal tax liability.

In the earlier years, White House officials made a point of highlighting which government agencies were receiving the money, starting with the National Park Service in 2017. The tax documents released Friday show that Mr. Trump reported charitable donations totaling nearly $1.9 million in 2017 and just over $500,000 in both 2018 and 2019.

In a bad year for business, Trump didn’t take a full refund.

Mr. Trump reported nearly $16 million in business losses in 2020, which swamped his other income and left him with no federal income tax liability. But the tax documents show that he made nearly $14 million in tax payments to the federal government over the course of the year.

Those payments left him with the potential for a large income tax refund from the government — like the ones many taxpayers find when they go to file their taxes every spring. In Mr. Trump’s case, he chose not to immediately take the full refund available to him. He claimed a refund of just under $5.5 million, then directed the Internal Revenue Service to apply another $8 million to his estimated taxes for 2021.

His own tax law may have cost him.

The tax law Mr. Trump signed in late 2017, which took effect the next year, contained some provisions that most likely gave him an advantage at tax time — including the scaling back of the alternative minimum tax on high earners.

But one provision in particular drastically reduced the income tax deductions Mr. Trump could claim in 2018 and beyond: limits that Republicans placed on deductions for state and local taxes paid.

The so-called SALT deduction disproportionately hit higher earners, including Mr. Trump, in high-tax cities and states like New York. In 2019, he reported paying $8.4 million in state and local taxes. Because of the SALT limits included in his tax law, he was able to deduct only $10,000 of those taxes paid on his federal income tax return.

Those losses could have been mitigated at least in part by other sections of the law that were favorable to wealthier taxpayers like Mr. Trump.

Fred Trump is a silent actor in the returns.

Fred Trump, Mr. Trump’s long-deceased father, has continued to have an effect on his son’s finances.

In 2018, after a decade in which the former president declared no taxable income, he reported taxable income of more than $24 million and paid $1 million in federal taxes, nearly the entire total he paid as president.

That income, as previously detailed by The Times, appeared to be the result of more than $14 million in gains from the sale of an investment his father made in the 1970s, a Brooklyn housing complex named Starrett City, which became part of Mr. Trump’s inheritance.

But the new documents show that the effect of his inheritance in 2018 was far greater: Mr. Trump reported $25.7 million in gains from the sale of business properties that he and his siblings inherited or took through trusts, including the sale of Starrett City.

The sales of business properties Mr. Trump created himself came at a loss, however, dragging down his net proceeds and somewhat reducing his tax liability, the tax itemization shows.

That included a total of $1 million in property sold at a loss by 40 Wall Street, his office building in Lower Manhattan, and DJT Holdings LLC. He recorded another $1 million loss bailing his son Donald Trump Jr. out of a failed business to build prefabricated homes.

Mr. Trump also received tens of thousands of dollars in dividends while he was in the White House from trusts that were established for him when he was young, his tax returns show.

A new tax firm got involved in 2020.

For years, Mr. Trump used the accounting firm Mazars USA to prepare his taxes and those of his businesses. Donald Bender, Mr. Trump’s longtime accountant at Mazars, had long been listed on the former president’s taxes as his accountant.

The firm formally cut ties with Mr. Trump and his businesses this year, saying it could no longer stand behind a decade of annual financial statements it prepared for the Trump Organization.

But it turns out Mazars and Mr. Trump had begun distancing themselves from each other as early as 2020. That year, BKM Sowan Horan, a Texas-based accounting firm, prepared Mr. Trump’s taxes, his returns show.

Republicans are threatening retaliation.

The release of the documents on Friday set off a new round of attacks between Democrats and Republicans on Capitol Hill, including threats of escalating — and politically motivated — future releases of private tax information.

Democrats cast the move as necessary oversight on a president who broke decades of precedent in declining to release his returns.

“Trump acted as though he had something to hide, a pattern consistent with the recent conviction of his family business for criminal tax fraud,” Representative Don Beyer, Democrat of Virginia and a Ways and Means Committee member, said in a news release. “As the public will now be able to see, Trump used questionable or poorly substantiated deductions and a number of other tax avoidance schemes as justification to pay little or no federal income tax in several of the years examined.”

But Republicans — who won control of the House in November — warned Democrats that they had started down a dangerous road, and that public pressure could push the incoming majority to release returns from President Biden’s family or a wide range of other private individuals.

“Going forward, all future chairs of both the House Ways and Means Committee and the Senate Finance Committee will have nearly unlimited power to target and make public the tax returns of private citizens, political enemies, business and labor leaders, or even the Supreme Court justices themselves,” Representative Kevin Brady of Texas, the top Republican on the Ways and Means Committee, said in a statement on Friday.

Mr. Trump weighed in late Friday morning with an email statement that also raised the threat of retaliation.

“The Democrats should have never done it, the Supreme Court should have never approved it, and it’s going to lead to horrible things for so many people,” he said. “The great USA divide will now grow far worse. The Radical Left Democrats have weaponized everything, but remember, that is a dangerous two-way street!”