Dear Commons Community,

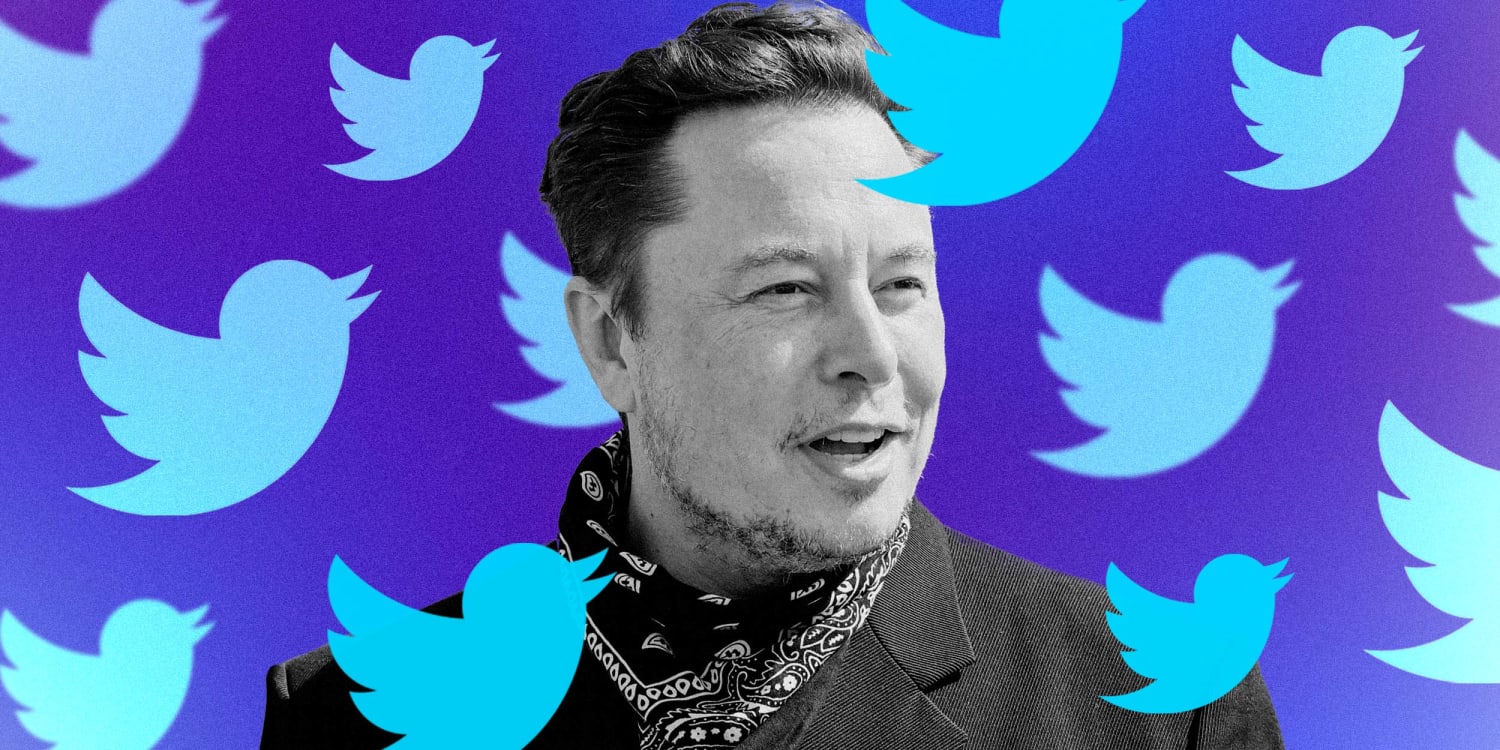

Billionaire entrepreneur Elon Musk offered to take Twitter Inc. private in a deal valued at $43 billion, lambasting company management and saying he’s the person who can unlock the “extraordinary potential” of a communication platform used daily by more than 200 million people.

The world’s richest person said he’ll pay $54.20 per share in cash, 38% above the price on April 1, the last trading day before Musk went public with his stake. The social media company’s shares were little changed at $45.81 in New York yesterday, a sign there’s skepticism that one of the platform’s most outspoken users will succeed in his takeover attempt. As reported by Bloomberg.

Musk, 50, announced the proposed deal in a filing with the U.S. Securities and Exchange Commission on Thursday, after turning down the chance to take a board seat at the company. Musk, who also controls Tesla Inc., first disclosed a stake of about 9% on April 4, making him the largest individual investor. Tesla shares fell about 3% on concern that the attempt to acquire Twitter will be a distraction for Musk.

Twitter said that its board would review the proposal and any response would be in the best interests of “all Twitter stockholders.” The board, which was set to meet to evaluate the proposal early yesterday, sees the takeover offer as unwelcome and will probably fight it, the Information reported, citing a person familiar with the matter.

In an interview at a TED conference on Thursday in Vancouver, Musk said he’s not sure he’ll succeed with the acquisition, and indicated that he has a Plan B if Twitter’s board rejects his offer. He declined to elaborate.

The bid is the most high-stakes clash yet between Musk and the social media platform. The executive is one of Twitter’s most-watched firebrands, often tweeting out memes and taunts to @elonmusk’s more than 80 million followers. He has been vociferous about changes he’d like to consider imposing at the social media platform, and the company offered him a seat on the board following the announcement of his $3.35 billion stake.

After announcing his stake, Musk immediately began appealing to fellow users about prospective moves, from turning Twitter’s San Francisco headquarters into a homeless shelter and adding an edit button for tweets to granting automatic verification marks to premium users. One tweet suggested Twitter might be dying, given that several celebrities with high numbers of followers rarely tweet.

Unsatisfied with the influence that comes with being Twitter’s largest investor, he has now launched a full takeover, one of the few individuals who can afford it outright. He’s currently worth about $260 billion according to the Bloomberg Billionaires Index.

Although Musk is the world’s richest person, how he will find $43 billion in cash has yet to be revealed.

“This becomes a hostile takeover offer which is going to cost a serious amount of cash,” said Neil Campling, head of TMT research at Mirabaud Equity Research. “He will have to sell a decent piece of Tesla stock to fund it, or a massive loan against it.”

At the TED conference Thursday, Musk said that if he succeeds in his bid, he would seek to retain as many other shareholders as the law allows for a private company, rather than being sole owner.

“I could technically afford it,” Musk said “But this is not a way to sort of make money. It’s just that I think this is — my strong intuitive sense is that having a public platform that is maximally trusted and broadly inclusive is extremely important to the future of civilization. I don’t care about the economics at all.”

Much of Musk’s ire against Twitter has been directed against what he perceives as censorship by the platform. In a letter to Twitter’s board alongside details regarding his offer, Musk said he believes Twitter: “will neither thrive nor serve [its free speech] societal imperative in its current form. Twitter needs to be transformed as a private company.”

It will be interesting to see how this plays out!

Tony