Dear Commons Community,

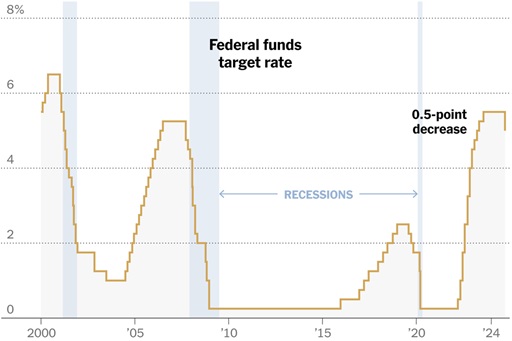

As expected, the Federal Reserve cut interest rates yesterday by half a percentage point. This rate cut will have ramifications for consumers, savers, and the overall economy. For consumers, it will mean lower interest rates on mortgages, car purchases, and credit-card debt. For savers, it will mean lower interest rates on CDs. For the overall economy, here are six takeaways courtesy of The New York Times.

- The Fed’s decision lowers rates to about 4.9 percent, down from a more than two-decade high.

- Fed officials lowered interest rates because they are confident that inflation is coming back down to their 2 percent goal, and now they want to prevent the job market from softening further.

- Central bankers expect to cut interest rates more in the months to come, but they are not on a preset path, Mr. Powell said. They could speed up if the economy is weak and slow down if it’s strong.

- The Fed is keeping a wary eye on the uptick in unemployment, but for now it thinks the economy is basically strong.

- The Fed is feeling “growing confidence” that it can pull off the soft economic landing by lowering interest rates.

- In short, the Fed has pivoted to its rate cutting era, and there is more to come.

All in all, this should be good news for most Americans!

Tony