Dear Commons Community,

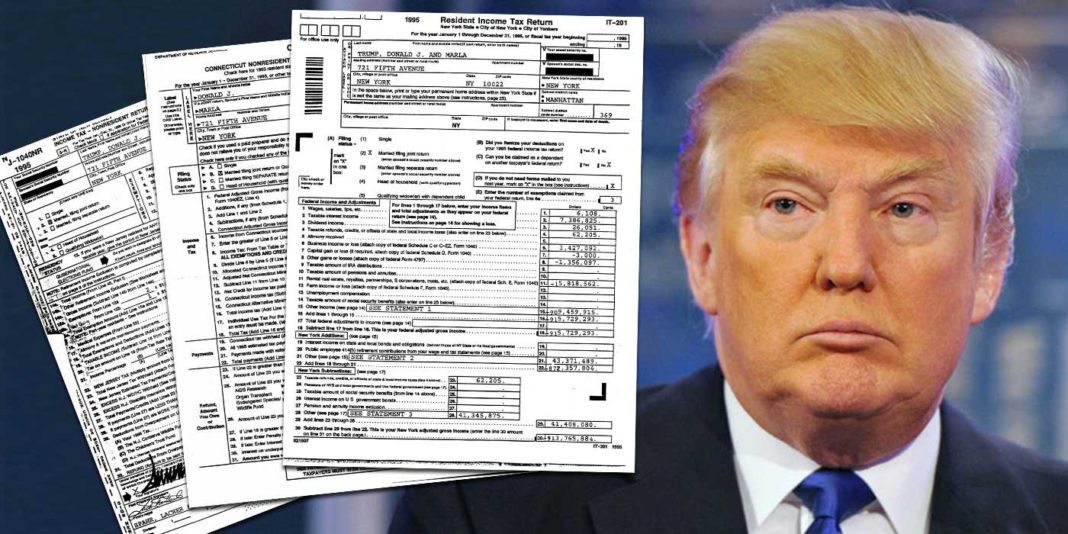

The US Supreme Court ruled yesterday that Manhattan District Attorney Cyrus R. Vance, Jr. can obtain President Donald Trump’s tax returns for a criminal investigation but sent a second request by Congress for the records back to lower courts. Here is a quick analysis courtesy of the Associated Press.

Q: WHAT WAS THE DISTRICT ATTORNEY’S CASE ABOUT?

A: The records were being sought for a criminal investigation by Vance are part of a broader probe that includes payments made to buy the silence of two women, porn star Stormy Daniels and model Karen McDougal, who claim they had affairs with the president before the 2016 presidential election. Trump has denied them.

Two Manhattan federal judges ruled in separate cases that the subpoenas could not be blocked by Trump. The 2nd U.S. Circuit Court of Appeals in Manhattan upheld the rulings late last year. The Supreme Court was left with the final word. It upheld the legitimacy of the subpoenas but returned the cases to the lower court to determine if Trump could limit the scope.

Trump has refused to release his tax returns since he was a presidential candidate, and is the only modern president who hasn’t made that financial information public.

Q: WHO WON?

Vance overcame Trump’s claims that he should be shielded from state criminal investigators while he is president. The high court sent the case back to the lower courts, but they largely threw out Trump’s argument.

The court turned away the broadest arguments by Trump’s lawyers and the Justice Department that the president is immune from investigation while he holds office or that a prosecutor must show a greater need than normal to obtain the tax records.

Vance, a Democrat, whose office recently won a #MeToo conviction against Harvey Weinstein, saw a “tremendous victory for our nation’s system of justice and its founding principle that no one – not even a president – is above the law.”

Trump’s lawyers also claimed a victory. Attorney Jay Sekulow, said he was pleased lawyers can argue in the lower courts that the subpoenas must be limited in scope, an argument Trump’s lawyers made all along.

Q: WILL ANYBODY SEE TRUMP’S TAX RECORDS BY ELECTION DAY?

Unlikely. Perhaps a grand jury will get to view some records in sealed proceedings, but the Supreme Court ruling all but wiped out any chance that Congress or the public will get to scrutinize Trump’s tax records by November.

The subpoenas by Congress and Vance will now be debated before federal judges in Manhattan, where any rulings on what can be turned over could be appealed again to the 2nd Circuit and the Supreme Court.

Even if judges expedite those decisions, the process will likely take weeks and even months to resolve fully. Records could then be released to a grand jury in Manhattan. Vance has said the records will not be made public.

Even the increasing likelihood that a grand jury will eventually get to examine the documents drove the president into a public rage. He lashed out declaring that “It’s a pure witch hunt, it’s a hoax” and calling New York, where he has lived most of his life, “a hellhole.”

Below is commentary by The New York Times Editorial Board.

It is my opinion that this decision will be a much more serious matter for Trump after he leaves office especially with the criminal investigation case in New York.

Tony

The Supreme Court Lets Trump Run Out the Clock

The justices reiterated that no president is above the law, but voters still won’t see his taxes before November.

By The Editorial Board

- July 9, 2020

In two major cases on Thursday, the Supreme Court rejected President Trump’s attempt to avoid all legal scrutiny of his financial records and reaffirmed the principle that undergirds any democratic society: No one, not even the president, is above the law.

That’s the good news. It’s also the bare minimum Americans should expect. The bad news is that Mr. Trump has again figured out how to game the legal system to his advantage, to dance along the edges of the law that the rest of us are expected to abide by.

The bottom line is that Mr. Trump will almost certainly get to keep hiding his tax returns (Remember those? The ones he promised to release five years ago?) and his other financial records from the American people, who will be asked to decide in a matter of months whether to give him another term.

From the day he took office, Mr. Trump has governed as though democratic checks and balances are optional. “I can do whatever I want,” he has said, more than once. This includes intervening in federal prosecutions to protect his friends, soliciting foreign interference in American elections and tear-gassing peaceful protesters for a photo op.

Nearly 250 years after another ruler’s abuses of power drove the American colonists to revolution, the lesson remains clear: We must always keep close watch on our leaders. In two separate decisions on Thursday, the Supreme Court reminded Mr. Trump of that history, ruling 7 to 2 that he could not ignore subpoenas of his financial records from Congress and from a New York prosecutor.

“In our judicial system, ‘the public has a right to every man’s evidence,’ ” Chief Justice John Roberts wrote for the court in Trump v. Vance. “Since the earliest days of the Republic, ‘every man’ has included the president of the United States.”

The case concerned a subpoena for Mr. Trump’s tax returns issued by Cyrus Vance Jr., the Manhattan district attorney, who appears to be investigating whether Mr. Trump and others broke campaign-finance laws before and during his presidency. Mr. Trump claimed “absolute immunity” from the subpoena. On that point, the justices shot him down unanimously.

“No citizen, not even the president, is categorically above the common duty to produce evidence when called upon in a criminal proceeding,” the chief justice wrote.

The court rejected Mr. Trump’s claim that answering the subpoena would distract him from his official duties — an amusing gripe from a president who seems to spend most of his day watching cable news and spouting off on Twitter. “Courts in the past have given ‘broad deference,’” the president tweeted in response to the ruling. “BUT NOT ME!”

That’s not true, of course. As the court pointed out, Presidents Richard Nixon and Bill Clinton lost the same argument by unanimous rulings, and with cases that were stronger than Mr. Trump’s. The claim of presidential immunity “runs up against the 200 years of precedent establishing that presidents, and their official communications, are subject to judicial process, even when the president is under investigation,” the court wrote.

In the other case decided on Thursday, Trump v. Mazars, the court took on Mr. Trump’s argument that he did not have to answer to Congress. Last year, three separate House subcommittees subpoenaed Mr. Trump’s accounting firm and a bank for his family’s and his business’s financial records. The subcommittees said they needed those documents to draft laws relating to Mr. Trump’s possible foreign or domestic conflicts of interest, as well as to government ethics, banking and foreign interference in elections.

“When Congress seeks information needed for intelligent legislative action, it unquestionably remains the duty of all citizens to cooperate,” Chief Justice Roberts wrote. In other words, Congress can subpoena the president’s records, and courts can enforce those subpoenas. But presidential subpoenas also raise “special concerns” regarding the separation of powers, the court said. It laid out factors that courts must consider, including the need for such evidence, the amount and nature of evidence being sought and the burden a subpoena places on the president.

Justices Samuel Alito and Clarence Thomas dissented from both rulings, although they agreed with the central point that the president does not have absolute immunity.

Still, the upshot of these rulings is that, while Mr. Trump is not legally immune from investigation, he is effectively immune from it. Rather than uphold the validity of the subpoenas, as the lower federal courts had done, the Supreme Court sent both cases back to the lower courts, giving Mr. Trump another chance to delay and come up with more arguments about why the American people should be kept in the dark. (Mr. Trump could still be criminally prosecuted by the Manhattan D.A.’s office after he leaves the White House.)

Whether he was breaking fair-housing laws and cheating on taxes as a real estate developer, or interfering with federal investigations into his own abuses of power as an elected official, Mr. Trump has always staked his survival on the fact that the wheels of justice grind slowly.

The American people need to know as much as possible about their presidential candidates. They need to trust that the person they choose will put the nation’s interests ahead of his own. As long as Mr. Trump is president and can hide his vast web of finances, they will never be able to do so.

What is the solution? Mr. Trump won’t release his tax records voluntarily. The Internal Revenue Service, apparently, won’t look at them as required by law. Neither Congress nor a state prosecutor is likely to get them before the election. And congressional Republicans have, with virtually no exceptions, bent the knee.

The court’s rulings hold the line, at least — ensuring that presidents cannot simply disregard congressional oversight or criminal investigation. But the fact that it took nearly a full term in office for the courts to articulate such a fundamental constitutional truth, and that still Congress and the American people will be left wondering, is damning evidence that justice delayed is justice denied.