Dear Commons Community,

According to the Pew Research Center, Americans owe about $1.6 trillion in student loans as of June 2024 – 42% more than what they owed a decade earlier. The increase has come as greater shares of young U.S. adults go to college and as the cost of higher education increases.

The basis for its conclusion is the Center’s analysis of data from several sources, including the Federal Reserve Board’s 2023 Survey of Household Economics and Decisionmaking. Here is a short summary.

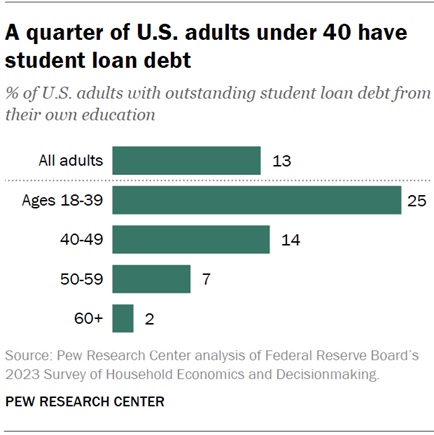

One-in-four U.S. adults under 40 have student loan debt. This share drops to 14% among those ages 40 to 49 and to just 4% among those 50 and older.

Of course, not all Americans attend or graduate from college, so student loan debt is more common among the subset of people who have done so. Among adults under 40 who have at least a four-year college degree, for example, 36% have outstanding student loan debt.

Age differences reflect, in part, the fact that older adults have had more time to repay their loans. Still, other research has found that young adults are also more likely now than in the past to take out loans to pay for their education. In the 2018-2019 academic year, 28% of undergraduate students took out federal student loans. That’s up from 23% in 2001-2002, according to data from College Board – a nonprofit organization perhaps best known for its standardized admissions tests (like the SAT) that also documents trends in higher education.

The amount of student loan debt that Americans owe varies widely by their education level. Overall, the median borrower with outstanding student debt owed between $20,000 and $24,999 in 2023.

- Among borrowers who attended some college but don’t have a bachelor’s degree, the median owed was between $10,000 and $14,999 in 2023.

- The typical bachelor’s degree holder who borrowed owed between $20,000 and $24,999.

- Among borrowers with a postgraduate degree the median owed was between $40,000 and $49,999.

Looking at the same data another way, a quarter of borrowers without a bachelor’s degree owed at least $25,000 in 2023. About half of borrowers with a bachelor’s degree (49%) and an even higher share of those with a postgraduate education (71%) owed at least that much.

Adults with a postgraduate degree are especially likely to have a large amount of student loan debt. About a quarter of these advanced degree holders who borrowed (26%) owed $100,000 or more in 2023, compared with 9% of all borrowers. Overall, only 1% of all U.S. adults owed at least $100,000.

My colleague Patsy Moskal at the University of Central Florida alerted me to this study by the Pew Research Center.

Tony