Dear Commons Community,

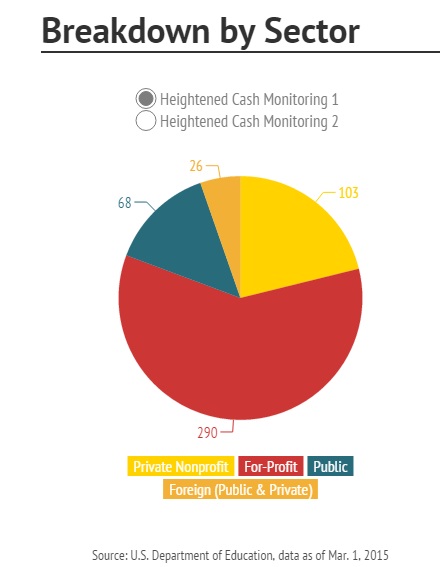

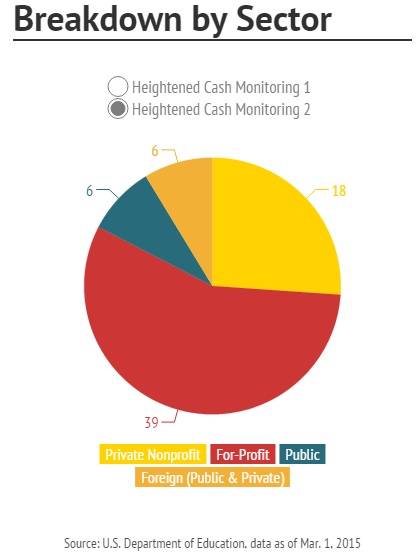

The U.S. Department of Education, for the first time, named 560 colleges whose federal aid it has restricted because of concerns about their finances or compliance with federal requirements. The department released a partial list of the 560 institutions that, as of March 1, were subject to the financial restrictions known as heightened cash monitoring. The charts a the end of this posting show the breakdown of the colleges on the list by sector. The first chart for what the U.S.DOE terms “Heightened Cash Monitoring 1 and the second chart for “Heightened Cash Monitoring 2”. The latter is the more restrictive. Most of the colleges — 487 institutions — were on the level 1 of scrutiny, and 69 were subject to the level 2 higher, more stringent restrictions. As reported in Inside Higher Ed:

“We feel that by issuing this list we’re doing what’s right for good government and transparency’s sake,” said Ted Mitchell, the undersecretary of education.

The department continued to kept secret the identities of 21 of the 69 colleges that it placed on the highest level of monitoring, which means that department employees manually approve every dollar that flows to an institution. Nearly all of those unidentified colleges were on that status because a federal audit of the institution resulted in “severe findings.”

“We have ongoing investigations at each of those institutions and we fear that, at this point, releasing those names would impede the progress of our investigation,” Mitchell said in an interview. He said the names of those colleges would eventually be released as the investigations are completed.

Mitchell said that colleges may be placed on either form of cash monitoring for a range of reasons, some of which are more serious than others.

The department, for example, may impose the sanction on a college for submitting its financial statements late. That appears to have been the case for 43 public colleges and universities in Minnesota, all of which were on cash monitoring with the designation of “audit late/missing.”

At the other extreme, a college may land on cash monitoring because of serious concerns about its financial viability. Roxbury Community College, in Massachusetts, for instance, is on cash monitoring because of concerns about its “administrative capacity.” The college released a report in 2013 that showed, among other things, that administrators had lost track of significant amounts of money.

A college being on the list “is not necessarily a red flag to students and taxpayers, but it can serve as a caution light,” Mitchell wrote in a blog post. “It means we are watching these institutions more closely to ensure that institutions are using federal student aid in a way that is accountable to both students and taxpayers.”

Before releasing the names of the institutions on cash monitoring Tuesday, the department had fought to keep the information secret. As recently as last week, the departmentsaid that disclosing the list was likely to result in a “substantial competitive injury” for colleges operating in a competitive marketplace.

The department reversed its position late last week afterInside Higher Ed reported that the cash monitoring information was largely being kept hidden from public view.

When Inside Higher Ed first requested the cash monitoring list last summer, the department denied the request and claimed that it did not keep such a list.

Going forward the department plans to publish the cash monitoring list online and update it on an ongoing basis, but it hasn’t yet decided how frequently, Mitchell said.

Many of the colleges on the lower level of monitoring, which typically places a several-day delay on colleges’ federal funding, are placed there automatically because they fail the department’s standards of financial responsibility.

For-profit colleges made up more than half of the institutions on each level of heightened cash monitoring. Of the 487 colleges facing the lower level of scrutiny, mostly for failing the department’s financial responsibility test, 290 were for-profit institutions including Corinthian Colleges and ITT Educational Services. Similarly, for-profit institutions represented 39 of 69 colleges facing the more stringent restrictions.”

Tony

Debi,

If you click on the “partial list of the 560 institutions” in the second sentence of the posting, you can review the list of colleges.

Tony

Is Capella University, Minnesota on the list? I had only $5,00 or less in loans for an administrative credential, but accrued $172,000 for PhD from Capella. This gets me $50 a month from my school district. I was ABD for 5 years ands they continued to charge tuition! I had a payment of $934 per month and when I filed married/joint on CA tax return my payment jumped to $1,893 per mo! I could not pay this so went into deferment (continued to pay $934) for a year until last month when I changed tax return to married/single. I am now awaiting new payment. I am 56 and at the end of my career in education and I think charging tuition like this is horrendous!

Debi